What Boards Can Learn From Football Teams

Football fans recognize the importance of mechanics.

Who's on the field, their specific roles, the tasks to be performed and how each player approaches the game largely depends on three things - whether the teams in offense or defense, the score on the board and the time on the clock.

Mechanics are the basis of team rules. They describe how each player must interact with each other and the game to achieve the team's objective.

But break a team rule and watch what happens. The play breaks down, the coach throws down his headset and the players try to hide their disappointment. And, after the game, when the team gathers for their review, they're not reviewing the score but the broken mechanics.

Whether on the football field, the battle field or even in the boardroom if the team understands and executes on the right mechanics they're half way to success. The other half is their combined talent, teamwork, and leadership. Boards direct with one but not the other and wonder why they still fail.

I've coined the expression boardroom mechanics to describe team rules for directors and the remainder of what I call the directorship team (for more on the directorship team see here).

The boardroom is not the playing field but it does shares a feature that makes mechanics the ready made conceptual framework for designing team rules for the directorship team - modes. A mode is a way or method of approaching a task. For example, in football the dominant modes are offense and defense.

Watching a football team you notice modes in action:

the mode will change depending on the situation; and

the team, their tasks, their actions and behaviors will change between modes.

Modes make it possible to design the mechanics that keep the team in alignment with the objective no matter how things change.

My insight is to bring the idea of modes and mechanics into the boardroom and design tools that help directors and everyone else in the boardroom to perform at their best.

Understanding Modes

Each philosophy of directing has its dominant modes. This is likely to be news to many. But I can assure you that directors operate in modes whether they are aware of it or not.

The two dominant modes of contemporary corporate governance are surveillance and interrogation or if you prefer monitoring and questioning. Based on the objective of protecting shareholders, these two modes underpin popular governance models and frameworks.

But these are not the exclusive modes of directing. Directors can choose different modes depending on the chosen objective for the board.

Monitoring and questioning might make sense if the goal is to protect a shareholder value, but if the goal is to increase enterprise value I argue there are much better modes to choose from.

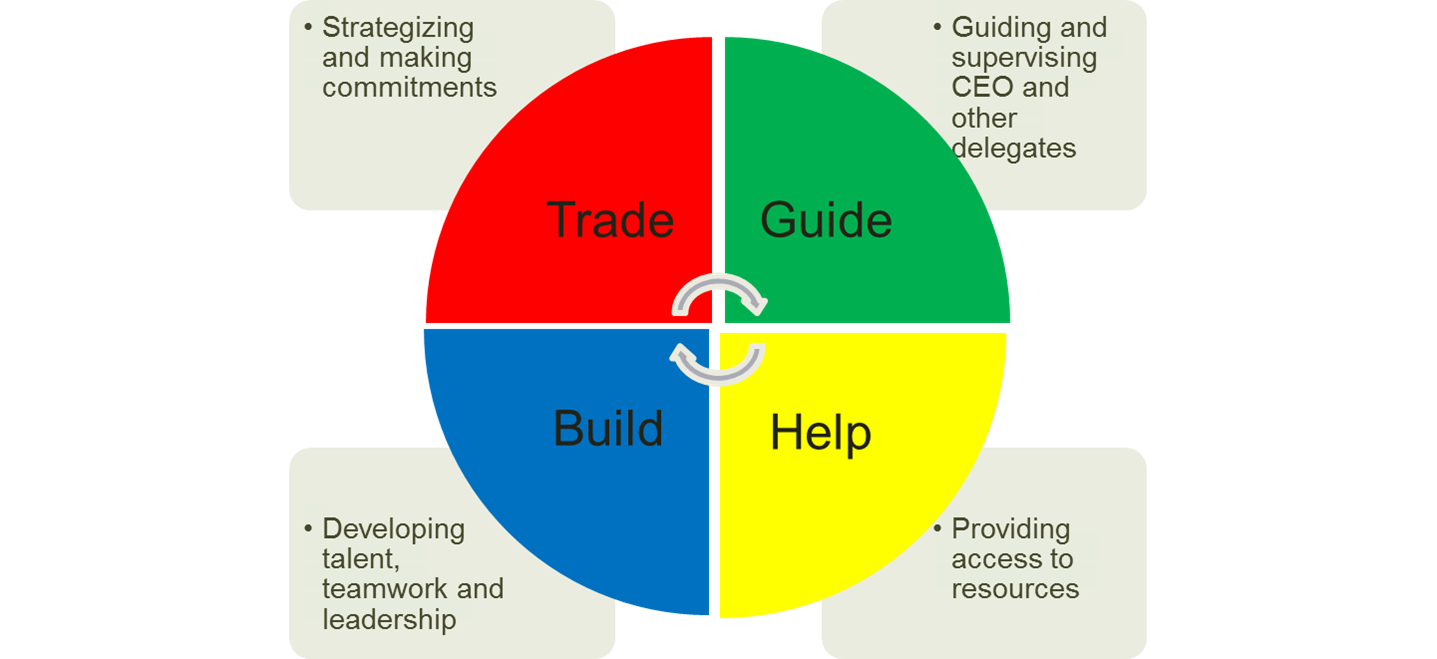

I propose four alternative modes of directing designed to directly or indirectly increase the strength, resilience and endurance of the corporation:

for more on modes click here.

Understanding Mechanics

Based on these modes of directing, I set out to answer the two questions every director should ask them self:

Given the situation which mode will create the greatest strength, resilience and endurance for the corporation; and

Given the strategic choice of mode, what tasks need to be performed, who do we need, what are the necessary roles, information, behaviour or actions for that mode.

Mechanics answers these questions and brings the board and the rest of directorship team into alignment at every level with the goal of enterprise value.

Here's one example of what I mean. How the board and the CEO behaves is recognized as critical to boardroom effectiveness and efficiency. In recent times, the approach of governance experts has been to identify the behavioral or personality types that exhibit better behaviors.

My approach is to identify the types of behaviour that are aligned or correspond with each mode of directing. Think of modes as providing a way of matching the behaviour of each director and the CEO to the tasks that fall within that mode. For example, in trade mode the board might be debating a major acquisition and they need to bringing the right game to the task. That means taking personal responsibility and asking for the right information.

Here's some basic behavioral mechanics for each mode:

The same process applies to everything from tasks, roles, actions and even information. Each mode has a series of mechanics that answers the question of what a director must do at any given time. One size doesn't fit all and no size fits all the time.

To see how the tasks of directing are classified by mode click here.

But the true potential of modes and mechanics is to change the way boards are evaluated. If a board or CEO is misbehaving the chances are they're bringing the wrong game to the task. It's what I call broken mechanics and there are at least eight different types of broken mechanics where the symptoms are well known but the cause is a mystery.

Modes and mechanics provide a real alternative to current board evaluation tools. Rather than benchmarking just the board against so called best practice for the 10th time, my approach enables boards to design their own team rules and, like the football team, systematically evaluate the effectiveness of the rules and identify who's breaking them. But more importantly, it provide the tool to repair the mechanics to improve performance the next time.

The Future of Directing

The least innovative solution to the challenge of continual innovation is to form a new innovation committee.

True innovation requires the courage to embrace imagination and to design creative strategies and tactics that your competitors thought was impossible.

The above is just a small glimpse of my imagination and a taste of what is possible. Be assured my model of means, modes and mechanics expands into a systematic framework of directing that answers the question what must a director do.

Directorship might not be the innovation you expected but it may be the inspiration your boardroom needs.