Commercial Capitalism

Commercial capitalism is an economic system based on the concepts of capital, value, work and capitalisation:

Anything that can bring about positive change has value - value is another word for work.

Value is stored in capitals.

The types of capitals include human, intellectual, social, natural, manufactured and financial capital to name a few.

Capitals posses different qualities that determine the amount of work they can do or their value.

The interplay of qualitative and quantative differences between the various capitals are at the heart of value creation.

As a general rule, value is created when low quality capitals are transformed into higher quality capitals. The latter possessing greater value than the first and therefore capable of bringing about greater change.

The history of capitalism is the history of value, capital and transformation or what I term capitalisation. Each epoch marked by a different vision of these core concepts.

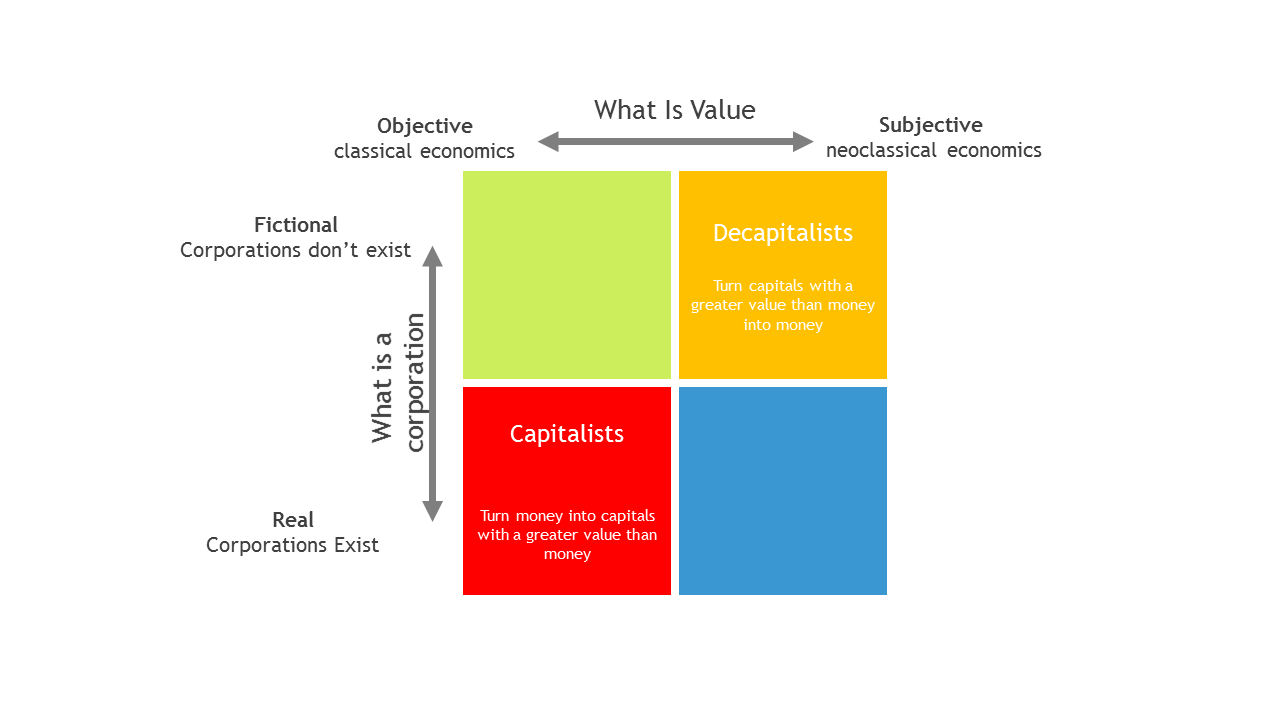

Classical economists like Smith, Ricardo and Marx thought value was objective - value was the work that went into something. Neoclassical economists considered value subjective - value is represented by the price that falls at the intersection of scarcity and demand.

To the modern commercial capitalist value is social and physical energy. Value is the measure of the energetic potential of a thing to do the work of change.

Value is energy in its social form

And like energy, value can be stored in things called capitals:

Whereas Marx focused on the past and the neo-classical economist focus blindly on the present, the commercial capitalist is focused on the future. The value of a capital is based on what it can be transformed into.

The principles of commercial capitalism are deceptively simple:

each type of capital possesses a different capacity to bring about change;

value is created when one type of capital is transformed into another.

By interposing a business model between the various capitals the commercial capitalist is able to exploit these differences in value to create greater value. The more efficient the transformation the greater the value created.

To create value, think like a physicist

In its most basic form, a business model is an "energy structure" or technology for transforming capitals to produce more value than that expended in its production. Control, activity and resources systems combing to convert and exchange capitals into greater useful value. And to repeat the point, greater value does not necessarily mean more money. It means a greater ability to bring about change through the interplay between the quality of capitals and the quantity of value stored in each.

What emerges from these principles is a pragmatic form of capitalism. The goal is not the accumulation of money but the accumulation of capacity to bring about positive change - value.

Decisions are guided by the ratio of value return from economic activity on value invested for that return. When all capitals are tallied and reduced to their common measure of capacity to bring about change is the ratio positive or negative? A positive return indicates value was created. The economic activity resulted in a greater capacity to effect positive change. A negative return means a reduced capacity and a destruction of value.

The objective of commercial capitalism is to accumulate value in all its forms yielding the greatest capacity to effect positive change over the longest time.

In Adam Smith’s pin factory, financial capital could be transformed into human capital which was then transformed in manufactured capital - 10 pins. But with the addition of intellectual capital, in the form of the know how to divide labour, the same capitals could produce 480 pins. But unlike the financial capital and human capital, the intellectual capital did not exhaust through use. It increased. The intellectual capital did the work of 48 people and their wages! This is no magic trick. It’s the laws of capital conversion at work.

The history of man is dominated by, and reflects, the amount of available energy— Frederick Soddy Science and Life (1920),

Capital in its monetary forms exhausts through use so can only affect change once. Capital in the form of intellectual capital doesn’t and can increase through use. Intellectual capital keeps working day in day out. Transforming low value financial capital into high value intellectual capital therefore delivers a positive return on value. Less money but more value! In other words, the amount of available energy has increased.

Contrast commercial capitalism with the current epoch which is best described as "decapitalism".

To transform capitals with a greater value than money into money is fools alchemy.

Decapitalism is marked by a belief in the primacy of financial capital that leads to a systemic negative return on capitals - where the value (capacity/energy) invested and stored in social, human, intellectual, natural and other forms of capital is greater than the value (capacity/energy)received from that investment and returned in the form of profit. Under the conditions of decapitalism financial capital increases but total value stored across all other forms of capital is in decline. Decapitalism leads to a capitals crunch - more money but less total value to do work into the future. You may know this as “short termism”.

The root of decapitalism lies in the confusion between money and value and the corporation and the shareholder. Decapitalists treat value and money as one and the same. Likewise, the decapitalist wrong conflates a corporation with its members. Concluding that the corporation has no separate existence to be maintained (but this discussion is for another time).

Capitalists vs Neoclassical Decapitalists

A stretched rubber band stores energy but the rubber band is not energy. Likewise, money is a store value but the money is not value. Each represents a form and store of energy/value. And in the same way that elastic energy is one of eight different forms of energy, financial capital is one of 8 different forms of value. Each form stored in a different type of capital.

What the 8 forms of energy and 8 forms of value have in common is that they all have the capacity to do work. And each form of value, like each form of energy has a different ability to do work based on its characteristics. These difference in capacity and value densities are critical to understanding how capitalisation works and value increases.

Value stored in financial capital does work as a medium of exchange. But as useful as it is, its capacity or the amount of work that financial capital can do is limited. Chiefly because money exhaust its value through use (and even non use). Spend a dollar and it’s gone. And, though its celebrated as a medium of exchange not everything can be transformed into money. If a Fortune 500 was wound up today and all its assets turned into financial capital, there would be a 70% shortfall on its market capitalisation. That’s because value is stored in many capitals that cannot be directly transformed into financial capital.

A stark illustration of the value of financial capital when compared to other capitals are the payments made by corporations to shareholders . Public corporations regularly lose ownership of their financial capital in the form of paying out dividends or buying back shares. In 2015, Australian listed companies agreed to pay $78 billion in dividends representing over 80% of earnings for the same period. What is most remarkable is how little impact this had on those companies. What would happen if a company lost 80% of its social, intellectual or human capital annually. Financial capital is the one capital a corporation can afford to transfer for the least return.

Social, intellectual and human capital are the things no company can afford to give away for little or no return. It is no accident that the largest corporations of the 21st Century are in the business of transforming financial capital (investment) into social and intellectual capital. These are the noble capitals that defy the limitations of financial capital. Unlike the base capitals, the more they are properly used the more work they can do.

To believe value and money are one and the same is to misunderstand the relationship between value and capital and the fundamental nature of capitalism. Imagine the poverty of a society that sought to store all their future energy needs in stretched rubber bands.

An economic system that seeks to maximise financial capital by transforming things with a greater value than money into money is not commercial (nor capitalist for that matter). Financial capital may increase, but in aggregate, the total energy/value created through the process declines . In other words, what was exchanged for money, had more embodied value/energy in it than the embodied value in the money received. This violates the irreducible principle of energy return on energy investment - the logic that governs the existence of all things. Deny this and eventually all things die. The roots of modern inequality lie in Milton Friedman’s neo-classical deception.

The paradox of modern capitalism is that more money and more commodities can mean less total available value. Seen through the prism of the capitals, value does not lie.

From a value perspective, commercial capitalism is agnostic when comes to the form of the capital accumulated. If anything is to be maximised it’s value. Provided an individual or corporation has sufficient financial capital to fund the process of capitalisation - the business model used to transform capitals into different forms - there is no logical reason why financial capital should always be maximized. If other forms of capitals have a greater capacity to bring about change it is both inefficient and irrational to maximise profit over those capitals.

The mantra of the commercial capitalist is simple - value above profit.

The implication of commercial capitalism are profound. The modern corporation is a prime mover. An energy structure that exploits the properties of capital to maintain existence. And in so doing advances social welfare by increasing the energy available to society in its social form - value. Through the lens of commercial capitalism, the promise of social welfare by corporation maximizing profit at the expense of value, is seen as nothing more than the decapitalist’s self serving lie.