What is Directorship ?

Over 60 years has passed since the word “corporate governance” entered the boardroom. In that time much has changed for company directors. But not the language. Company directors still have only word to describe what they do. Leaving boards defined by a term that ignores the binary nature of their role and responsibility.

Think of the word corporate governance and what comes to mind are things like structure and process. The focus is generally on protecting and preserving financial value through maintaining control and managing risk.

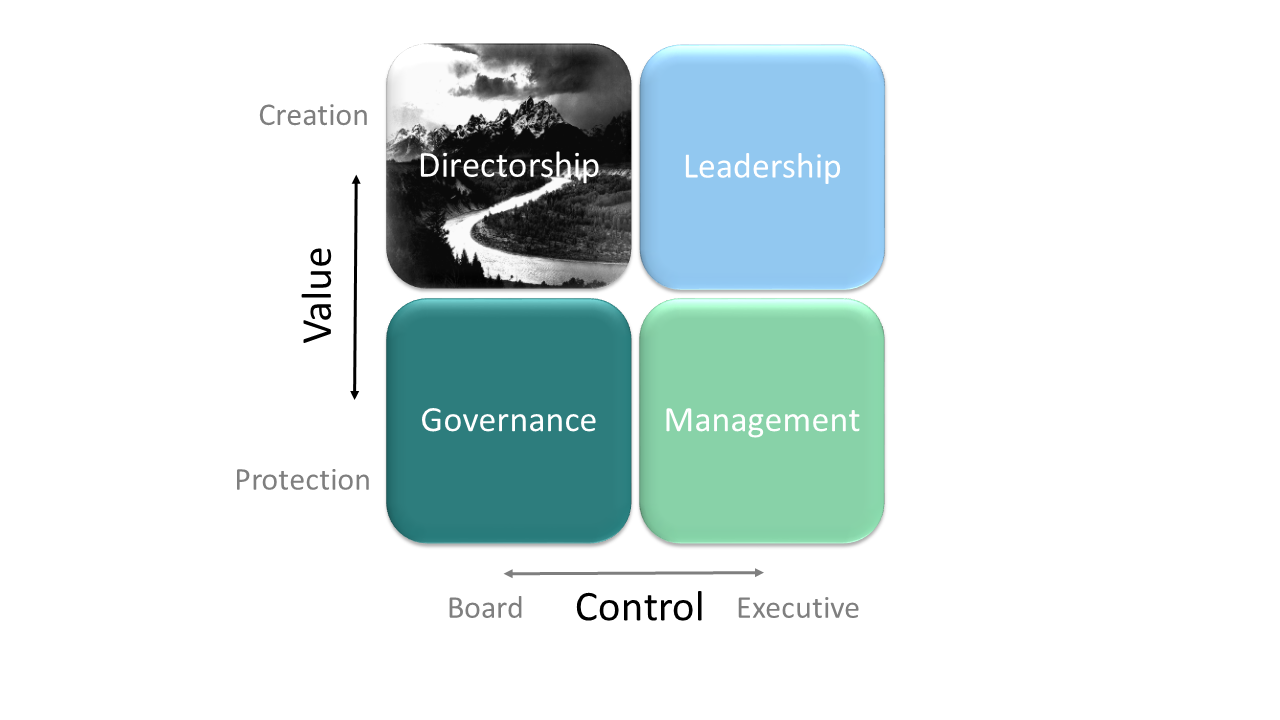

But there is another system of thought and action in the boardroom. One that focuses on value creation. I call it “directorship”.

Defining Directorship

Directorship noun the office of a company director and the period for which that office is held.

Directorship noun the act of value* creation by a company director. Encompassing a company director's acumen in decision making, ability to guide and inspire those to whom power is delegated, willingness to assist when required and desire to learn and improve.

"

* value being energy in each social form. Value is a quantitative property of a capital that is transferred to perform work or bring about change through a capital dynamic process. Capitals described by the International Integrated Reporting Council to include- natural, human, social, intellectual, manufactured and financial capital.

Governing and Directing are Different

There is no term in the language of corporate governance to describe a company director's role and skill in the process of value creation.

Historically the term "corporate governance" has been used to describe what company directors do. From the Greek "to steer". It was invented by Richard Eells in 1960 to denote "the structure and functioning of the corporate polity" and which has come to be closely associated with board structure, process and composition and managing "agency risk". In short, value protection with a traditionally strong emphasis on financial capital and share price. Little or no attention is paid to the board’s role as the creators of value.

How can the concept of value creation in the boardroom be understood, let alone researched and improved, if no word exists to describe the concept? And the only word used, more often than not, describes the opposite concept.

"It is impossible to speak of the objects of any study, or to think to think lucidly about them, unless they are named." (Blackwelder)

Despite Blackwelder’s comments being self evident, there is an overwhelming reluctance to validate the directors role as creators of value by giving it a name.

To be clear, governing and directing are fundamentally different concepts. To use governance to describe directorship is akin to describing management as leadership.

Indeed, Abraham Zaleznik, the Harvard Professor who, in 1977 wrote Managers and Leaders: Are They Different?, recognized the same problem when he asked whether managing and leading were different.

Zaleznik's recognized that not only did managers and leaders perform different tasks but they do so with a different ethos and approach to risk and value. Something that had previously been lost or overlooked by simply listing the tasks of management. .

The state of the boardroom mirrors the state of the c-suite before the professor's seminal paper. It's all corporate governance. Often reduced to a list of tasks - strategy formulation; policy making; monitoring and supervising; and, providing accountability (Tricker). The list may be accurate but misses Zaleznik's point. Hiding among the tasks is the insight that each can be grouped according to the mindset and system of thought and action aligned to performance.

In the same way that the c-suite approaches the task of leading and managing differently, by giving directorship a name, the boardroom can now ask whether governing and directing are different and think and act accordingly.

Etymology of Directorship

It was over a decade ago that I first proposed that directorship be used. I was immediately criticized for inventing a new word that only added to the confusion that surrounded the dozens of definitions of corporate governance.

In my defense, the origins of the word “director” and “ship” are historically grounded in value creation. I did not invent the word or its meaning. I simply resuscitated it to avoid the the problem I was accused of creating.

Director comes from the latin “dirigere” meaning "to set straight, arrange; give a particular direction to".

And though the suffix "ship" has traditionally combined with the noun "director" to describe the office - "She held three directorships", it has another meaning.

Ship is also used to denote an individual's capacity or skill. Think leadership, scholarship and sportsmanship. Ship coming from old english -sciepe "state, condition of being and schaeppen "to create a thing of value"which in turn is derived from the base word skap - "to create, ordain, appoint,".

Now consider that value creation and appointment at the core of the work of a company director:

"the board's most important role is to appoint and work with the CEO"

AICD

"Governing boards should take more active leadership of the enterprise, not just monitor it's management"

Ram Charan, Dennis Carey and Michael Useem

Why continue to call value creation in the boardroom “corporate governance” when the natural definition is “directorship”. The resistance to change is inexplicable for a profession that advocates change in others.

Usage

I first used “directorship” in "Directorship Made Simple". Published by the Australian Institute of Company Directors, the focus was on value creation.

Since then, the AICD has drawn a distinction between governance and directorship. Their website stating "We produce a range of publications on good governance and directorship" and "Our publishing arm provides up-to-date expert research, knowledge and insights on directorship, governance and performance." Likewise the AICD promotes their "highly-regarded and established governance and directorship programs". Though what they mean is unclear, it is implicit that governance and directorship are some how different.

The AICD even calls their glossary of terms for directors “the Language of Directorship”. But inexplicably fails to define the very term.

source: http://aicd.companydirectors.com.au/resources

Grant Thornton's report The Board: creating and protecting value, draws the same distinction between directorship and the board's more traditional role.

Source: http://www.grantthornton.co.uk/insights/the-board-creating-and-protecting-value/

Copyright in the above images are owned by the AICD and Grant Thornton respectively and are used for the purpose of review and reporting. Use of the images should not be taken as an endorsement of this post or its content by either organization.

Directorship Vs Corporate Governance

Directorship is to science what corporate governance is to economics.

Whereas corporate governance draws its inspiration and guidance from the assumptions of neo-classical economics, directorship is grounded in capital dynamics:

capital dynamics (noun)

The study of energy in its social form – value. The field examines the relationship between value, work, the forms of capital in which value accumulates, the entropic and other qualities of each form of capital and the conversion of value between different forms.

being or related to an entity considered isolated or separate from its surrounding in the study of capital dynamic processes.

The new science of value is based on these concepts

Value represents energy in its social form

Energy is stored in capitals

Each form of capital has macroscopic qualities that determine the the amount of work that capital can do

Value is created through capital dynamic processes -

An entity undergoes a capital dynamic process when there is some sort of value change within the entity.

Directorship is guided by VROI - value return on investment or best interest. Governance is guided by simple ROI.

For more read

Governing and Directing - Are they Different?

The New Science of the Corporation

Is a New Word Needed?

I once flew 24 hours to Paris to attend the International Corporate Governance Networks (ICGN) annual conference a decade ago. I arrived only to find a room of full of fund managers and investment bankers whose sole purpose was to increase the return on their investments by lobbying for "good" corporate governance. Value creation was on no one’s agenda.

I’m not the only one confused. After all, there are dozen of definitions of corporate governance.

The only ones who have no doubt as to what corporate governance is were the people in Paris. Their definition summed up by this statement from Sovereign wealth fund, Oslo-based Norges Bank Investment Management.

NBIM's goal is aligned with a commonly accepted definition of corporate governance, namely the way that suppliers of finance assure themselves a return on their investment.

For me, governance and directorship were two sides of the same coin. Both necessary but fundamentally different. But for the investment industry, governance is on both sides of the coin to ensure they win.

A problem best illustrated by the expression “good” governance.

The “good” in good governance is not benign. It is a classic example of a trick that British journalist Steven Poole called “unspeak”.

Unspeak is a technique whereby words such as “pro life” and “good governance” are used to neutralise argument and debate. Those who disagree with their policy goals are branded “anti life” or advocating for “bad governance”. Poole sums up the effectiveness of the technique as follows:

“it tries to unspeak – in the sense of erasing or silencing – any possible opposing view, by laying claim right at the start to only one way to looking at a problem.

In the context of the boardroom “good” is the unspeak of the investment industry. A rhetorical device designed to ensure that above all else the composition, processes and procedures is aligned with the investors commercial strategy.

Perversely, value creation is not part of good governance or its very short intellectual tradition. This may explain why there is no word to describe value creation in the boardroom Something that has served the investment industry well. But in the process we have all been captured by the language. Unable to see a role for the board beyond “good” governance and the financial interests of shareholders.

When we use the word directorship we reclaim the boardroom for the the benefit of all ( and not just the investment industry). Because when companies create value embodied in all 8 forms of capital society is energised.

Summary

There are dozens of definitions of corporate governance and no broadly held theoretical base for what a director does (Tricker). Only multiple polarizing views (Letza and Sun). And even the shareholder value theorists can't validate their claims or predict outcomes (Daily, Dalton and Cannella).

If there was one thing in common it is that corporate governance is primarily concerned with value protection - scrutinizing, question, measuring, counting and risk managing.

The reality for all directors is that value must be created before it is at risk of being lost.

Directorship describes value creation in the boardroom and the way it is practiced according to the principles of science - making good decisions, guiding and inspiring management, helping out and learning when to govern and when to direct. But without a name, a newly appointed director could be forgiven for assuming that their role was simply to practice “good” governance by monitoring management and not being afraid to ask the tough questions.