Five Ways To Fix Adam Smith's Big Mistake

Since the 1970’s corporate governance academics have arguably had more success in creating problems than solving them.

It started with the agency problem and the challenge to align managers and shareholders. But no sooner had CEO’s received their lucrative options than the next problem arose. CEO’s salaries kept rising and short-termism had become rife. The solution seemed obvious. Boards had become captured by management and what was needed were independent directors. But, being outsiders, many did not recognize that excessive risk was taking capitalism to the edge in 2008. You get the idea. Don't be surprised if the next crisis is blamed on gender quotas.

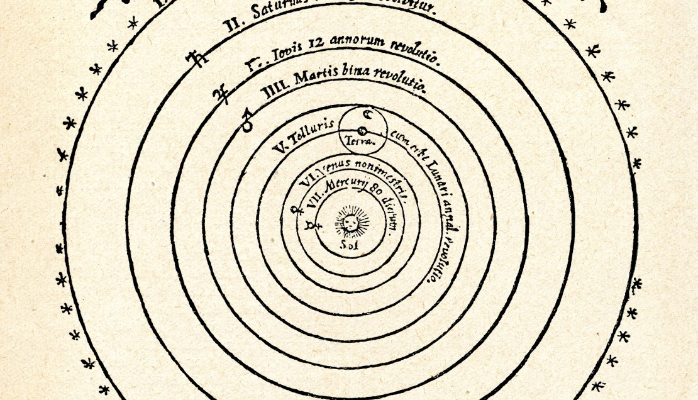

For students of history, a familiar pattern was emerging. In the time before Copernicus:

“Astronomy’s complexity was increasing far more rapidly than its accuracy and that a discrepancy corrected in one place was likely to show up in another.”

Kuhn was commenting on the crisis in Astronomy in 1543, but his description equally applies to the crisis in corporate governance in 2017.

Copernicus would of course break the cycle of failure in astronomy by replacing the Earth with the sun in the center of his universe. This paper argues that corporate governance is on a similar path, and that only by replacing the shareholder can we begin to fix the problems with capitalism.

Lesson One: Beware Copernican Monsters

In the preface to the Revolutions of the Heavenly Spheres, Copernicus comments of his contemporaries:

“Nor have they been able thereby to discern or deduce the principal thing – namely the shape of the universe, and the unchangeable symmetry of its parts. Within them it is though an artist were to gather the hands and feet head and other members for his images from diverse models, each part excellently drawn, but not related to a single body, and since they in no way match each other, the result would be a monster and not a man”.

According to Kuhn, Copernicus thought that an appraisal of astronomy in his time showed that the Earth centric approach to the problem of the planets was hopeless. Traditional techniques had and would never solve the puzzle, instead they had produced a monster.

It takes little imagination to see a Copernican Monster lurking within corporate governance codes and guidelines that share no common theoretical foundation other than to persist with a shareholder centric approach to the problem of corporate purpose. Little has changed since I first wrote:

“Corporate governance still has no broadly held theoretical base (Tricker, 2009) Instead, it is overwhelmed by multiple and polarizing theories (Letza and Sun, 2002) and though a number of broad or even global theories have been proposed (e.g.Hilb, 2006; Hillman and Dalzeil 2003; Nicholson and Kiel, 2004) none have gained acceptance. Most importantly, agency theory, widely recognized as the dominant theoretical perspective of corporate governance (Durisin and Puzone, 2009) continues to suffer from empirical research unable to validate its claims or accurately predict outcomes (Daily, Dalton and Cannella, 2003). “ *

In much the same way as students of Ptolemy could not accurately predict the movement of the planets, today’s students of the corporation confront the same challenge – a monstrous discipline unable to explain or predict anything other than crisis.

Lesson Two : Avoid Blind Spots

Johannes Kepler, who perfected the laws of planetary motion, understood his discipline's greatest weakness. When questioning why Copernicus had not seen that the planets moved in ellipses rather than circles he responded:

“ Copernicus did not know how rich he was, and tried more to interpret Ptolemy than nature”.

Again, corporate governance suffers a similar blind spot.

Scholars are more likely to interpret Isaac Berle or Merrick Dodd than look up and observe how corporations function in practice.

Since the debate between these two law professors began in the1930’s, the question of corporate purpose has divided into two camps. The first led by Berle argues that corporations have a responsibility to maximize shareholder value. The second led by Dodd argues that corporations have a responsibility to balance the interests of all stakeholders. These two approaches pull in different directions and compete to be the central blurred focus of corporate governance.

As much as 16th Century astronomers could not see the role of the Sun for an ancient astronomer, many modern scholars of governance can’t see the role for anything else for the Berle and Dodd debate. Captured by the shareholder versus stakeholder dichotomy academics cannot break the cycle of failure because they can't see beyond these false opposites.

Lesson Three : Understand the Power of Attraction

If pre-Copernican astronomy is a metaphor for the problems of corporate governance, does astronomy after after Copernicus offer a solution?

Adam Smith thought so. Quite literally.

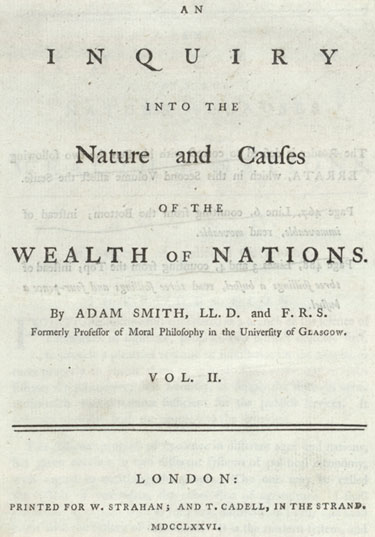

Smith was not an economist but a philosopher and, you guessed it, a student of astronomy. Not only did Smith write on the history of astronomy, but one of his greatest influence is the man who discovered the laws of planetary motion.

According to Smith, the laws of nature discovered by Isaac Newton could be found in the natural laws of commerce. Smith's concept of the invisible hand was a metaphor for the gravitational force of self-interest:

Is in this, as in many other cases, led by an invisible hand to promote an end which was no part of his intention. [...] Nor is it always the worse for the society that it was no part of it. By pursuing his own interest he frequently promotes that of the society more effectually than when he really intends to promote it.

Whereas Newton connected the movements of the planets by “so familiar a principle connection” as gravity, Smith had discovered the equivalent principle of mutual attraction in commerce.

To Adam Smith, the Merchant was to capitalism what the sun was to gravity. In a commercial society “everyman is a merchant” with its own invisible power of attraction. And, according to Smith, the merchant's self- interest and freedom dictate the natural order of commercial society:

It is not from the benevolence of the butcher, the brewer, or the baker that we expect our dinner, but from their regard to their own interest.

Now compare this explanation to the deontological theories of Berle and Dodd. Neither are founded in self-interest. Instead,they are based in rights and responsibilities owed by the corporation to shareholders and stakeholders. A careful analysis shows that both are anti-Newtonian and have more in common with biblical justifications of geo- centrism than anything argued by Smith.

In much the same way as gravity draws the Earth and the sun together, the ethical principle of self-interest drew the merchant and the customer together.

Lesson Four : Don't Believe Everything that Adam Smith Wrote

If Smith was right and capitalism was powered by self interest, why is the study of corporate governance so broken and confidence in capitalism collapsing?

The answer is that Smith sabotaged his own incredible idea by claiming that joint stock companies were managing other people's money:

The directors of such [joint-stock] companies, however, being the managers rather of other people's money than of their own, it cannot well be expected, that they should watch over it with the same anxious vigilance with which the partners in a private company frequently watch over their own.... Negligence and profusion, therefore, must always prevail, more or less, in the management of the affairs of such a company.

Smith had inadvertently put the shareholder at the center of capitalism, unaware that he had fundamentally corrupted his own idea. There were now two types of merchant. Those who could act in their own best interest and play by the rules of the invisible hand, and those bound to act out of a duty to others.

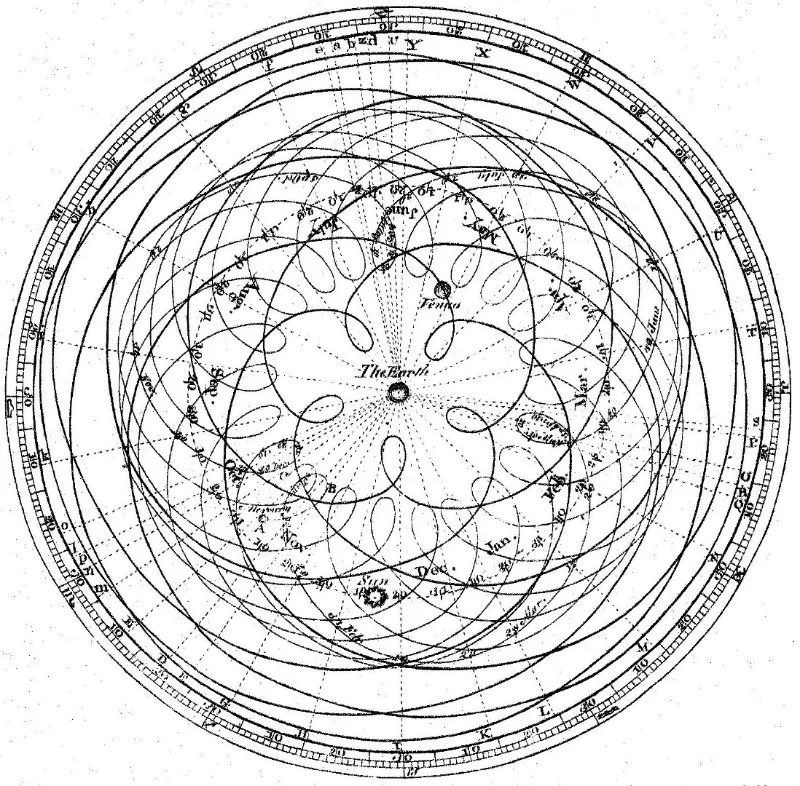

It was as if Newton, having derived his laws of gravitation from the laws of planetary motion, thought it logical that some planets revolved around the sun and others the earth.

A mistake picked up by Milton Friedman and all those who stood on his shoulders who argue that duty to shareholders comes before the self interest of the corporation. Put another way, unincorporated merchants are free to act in their own self interest but incorporated merchants are under a duty to act in the interests of their shareholders. This is not the free market and it is this flaw that is at the heart of modern "good" corporate governance systems that are destroying capitalism.

Which brings me the point where the parallel paths of corporate governance and astronomy cross

Lesson Five: Progress Loves a Revolution

In May 2015, the European Parliament’s Committee on Legal Affairs approved a revision to the 2007 Shareholder Rights Directive that is as revolutionary as it is heretical. Paige Morrow explains:

“(the amendment) explicitly acknowledge(s) that shareholders do not own corporations - a first in EU law. Contrary to the popular understanding, public companies have legal personhood and are not owned by their investors. The position of shareholders is similar to that of bondholders, creditors and employees, all of whom have contractual relationships with companies, but do not own them. “

Though the change was omitted from the final version of the Directive, Smith's error had been acknowledged and corrected.

By openly recognising that corporations are sovereign, distinct and independent entities, EU lawmakers joined with a growing number of corporate lawyers to invite us to end the futile Berle-Dodd debate and consider a third model of governance. A model not based on corporations revolving around the interests of shareholders or stakeholders, but in which those interests are served if they help to secure the corporations indefinite existence.

Each corporation is a merchant at the centre of their own universe encircled by all shareholders and stakeholders. All held in an elliptical orbit by the ever changing gravitational pull of the corporation's self- interest rightly understood. An invisible force that draws shareholders and stakeholders in and determines the proximity of their interests to those of the corporation.

After decades of legal practice, this hypothesis fits with my observations and the law. Smith's vision of capitalism realised through the sovereign corporation.

My proposition is that the central object in capitalism is the concept of personhood biological and corporate. Each a Smithian merchant in their own right having an innate inclination to continue to exist and enhance itself by aligning its self interest with the self interest of other merchants.

But what does a corporation's interest look like?

In the case of a corporation, an interest is one of the capitals. - human, intellectual, environmental, social, produced and financial. Commonly associated with Integrated Reporting <IR>, the capitals can equally be flipped to provided a complimentary accounting to explain how corporations maintain their existence.

Flipping the capitals results in the corporation becoming the first person and the capitals are thereby directed toward its interests. The symbol is >i< .

>i< Accounting is based on the proposition that a corporation must store and convert each of the capitals to maintain and enhance itself. Please note, >i< Accounting is based on the intrinsic interests of the corporation and not the extrinsic interests of shareholders or stakeholders. It is derived from a non teleological understanding of the corporation.

The basic proposition underlying >i< Accounting is that excess and lower value capitals (typically financial capital) must be converted by a corporation into rarer and higher non financial forms of capital (human, intellectual, social capital etc). The purpose of this is to enable the production of lower forms of capital (produced capital) which in turn must then be converted into financial capital which is then converted into rarer and higher forms of capital and on it goes. In the >i< model cost equals capitalization and properly understood is a virtue.

Theoretically this cycle of capital creation can continue into perpetuity provided the corporation does not exploit the sources of capital or do something stupid. And by so doing, the corporation obliquely serves the interest of all those who hold capitals. [A paper and model that explains the concept of >i< Accounting will be published soon].

To continue the astronomical metaphor and explain the mischief caused by Smith conflating the shareholder for the corporation, excessive shareholder influence causes a corporation to exhaust its energy and become a dying star.

Under the influence of shareholder primacy the corporation begins to convert its higher capitals human capital, intellectual capital, social capital etc into one of lowest forms of capital - financial capital. It's called "efficiency" and "costing out". The resulting financial capital is then transferred for limited or no capital return in the form of buy backs, dividends etc. If there is any doubt about this process consider that total payout to shareholders in the US as a percentage of net income of the corporation stands at unprecedented levels. You might call it short-termism. Drucker called it suicide:

“Everyone who has worked with American management can testify that the need to satisfy the pension fund manager’s quest for higher earnings next quarter, together with the panicky fear of the raider, constantly pushes top managements toward decisions they know to be costly, if not suicidal, mistakes,”

If the cost out process is allowed to continue, the corporation's value previously stored across all the capitals eventually becomes exhausted. Ultimately making the corporation less able to maintain its very existence. This process is the corporate equivalent of Cotard's syndrome. And, if the decline in the number of public companies and confidence in capitalism are any measures, its become a pandemic.

One day, the sovereign corporation will be no less obvious to corporate governance as the sun became to astronomy. And while ignoring the sun could only hurt the pride of the scholar, ignoring the corporation and its interests will continue to hurt the wealth of all nations. For this was Smith's promise. The interests of all stakeholders will be met but only if corporations reject the call to act in the interests of shareholders and embrace Smith's enduring call to action.