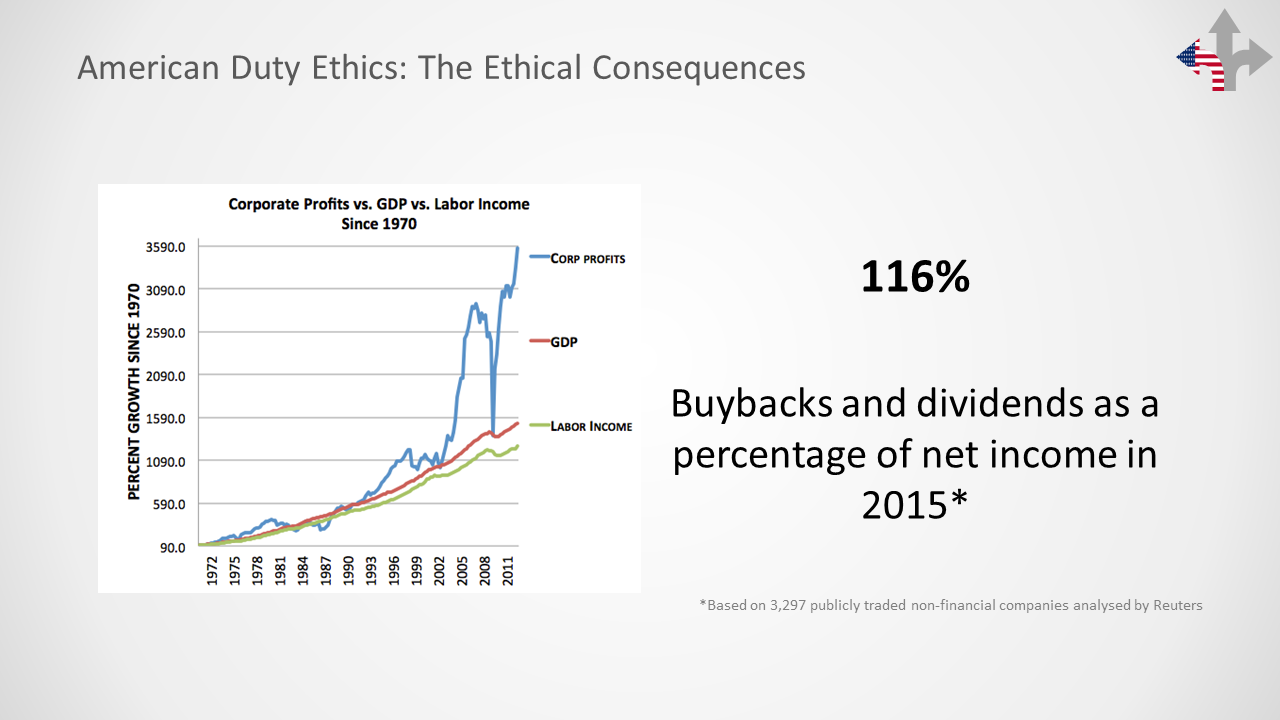

DuPont’ dismantles research teams that have provided a century of competitive advantage. Apple borrows billions to buy billions in shares that it can issue itself. Here in Australia, a major supermarket tells their suppliers that from now on they'll get paid in 60 days instead of 30.

What makes this behavior right or wrong?

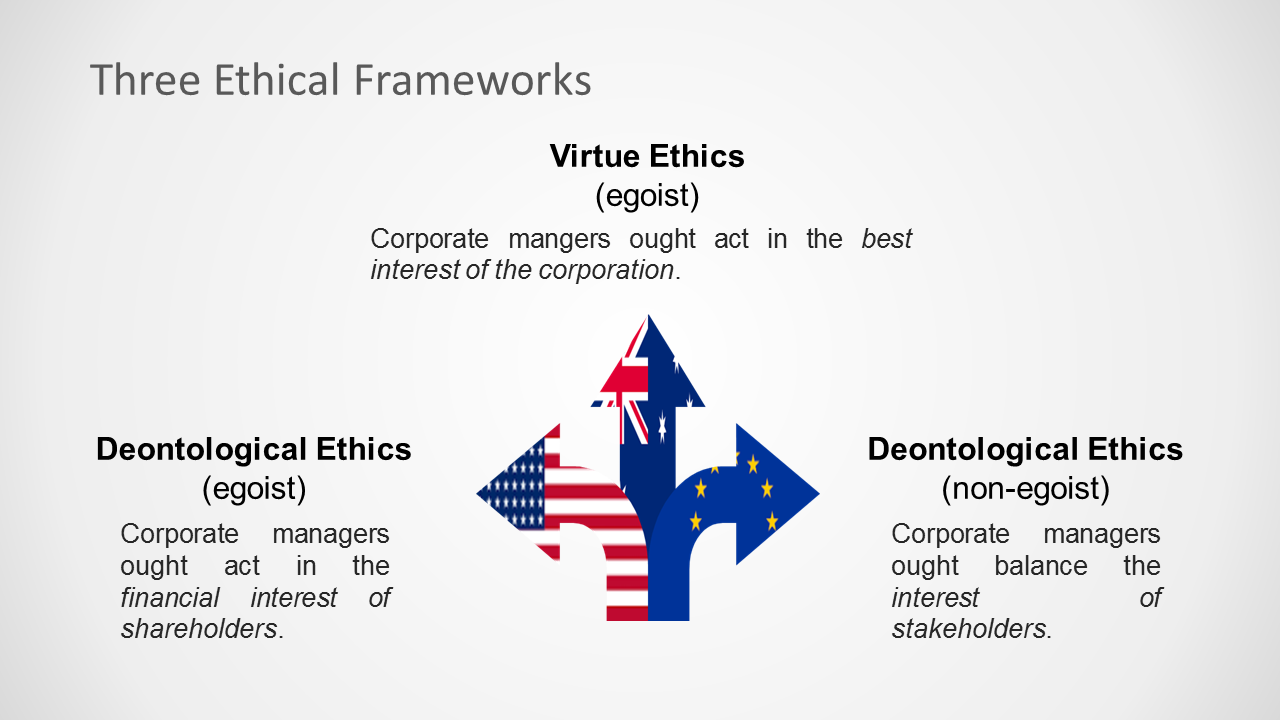

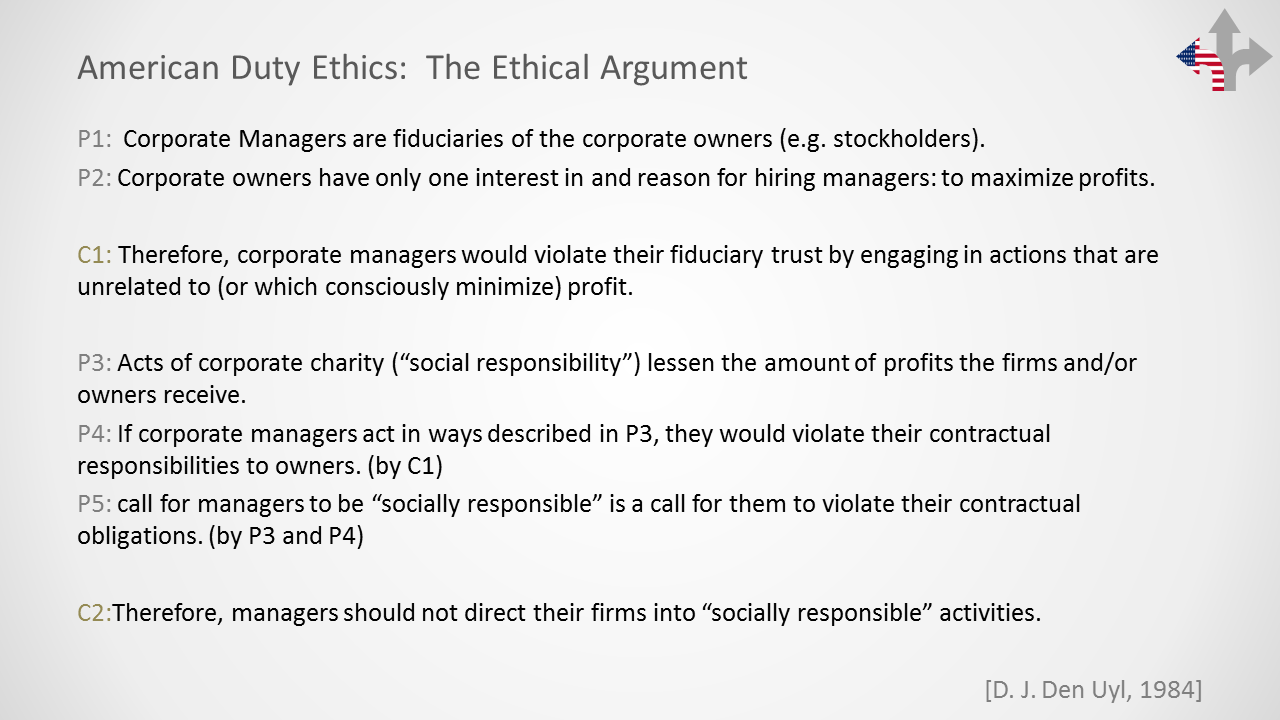

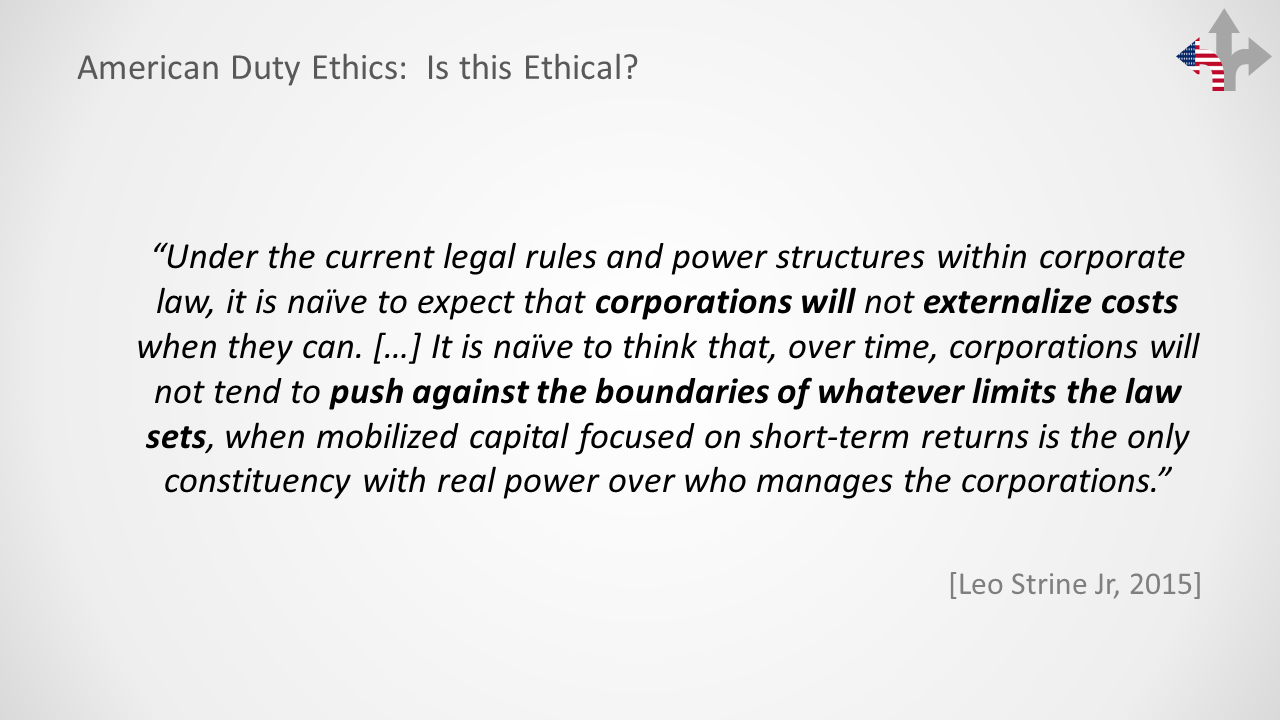

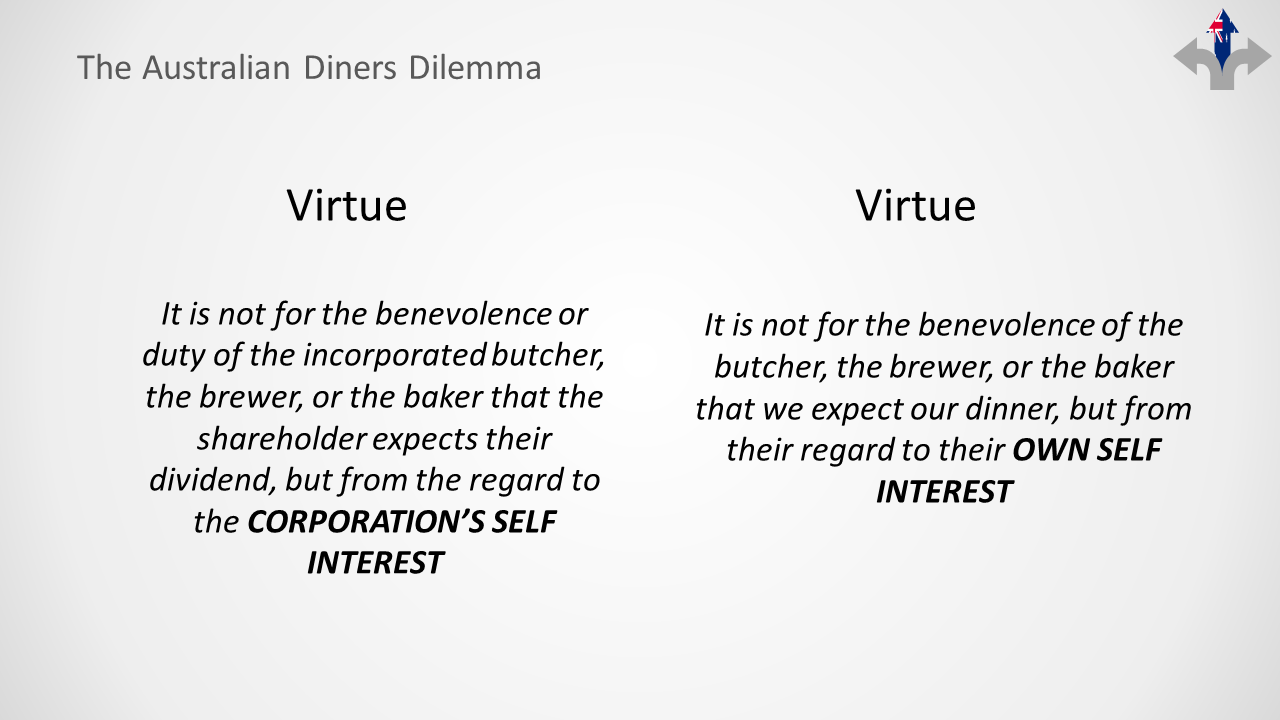

Milton Friedman thought ethics. Read his infamous essay " The Social Responsibility of Business is to Increase Profits" and it becomes clear that, for all the "unethical" conduct it has inspired, the vile maxim is principally about doing the right thing. Anything else, including corporate social responsibility, was subversive and wrong because it was unethical.

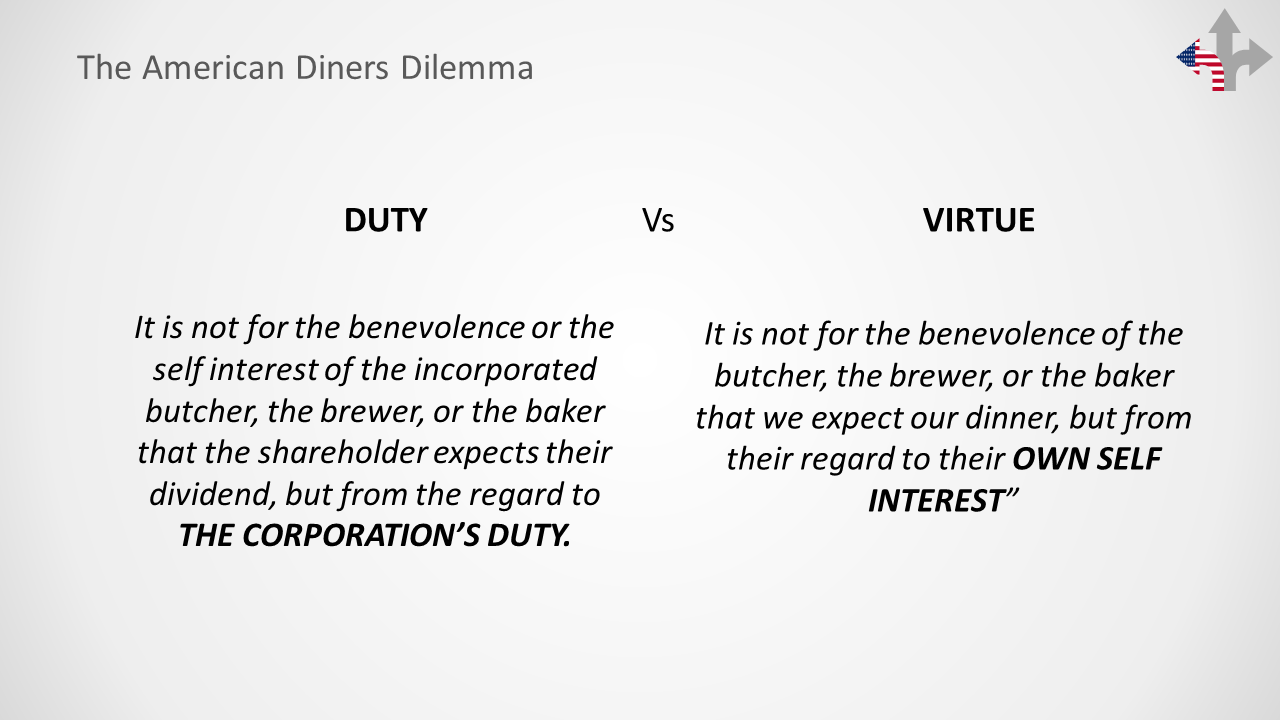

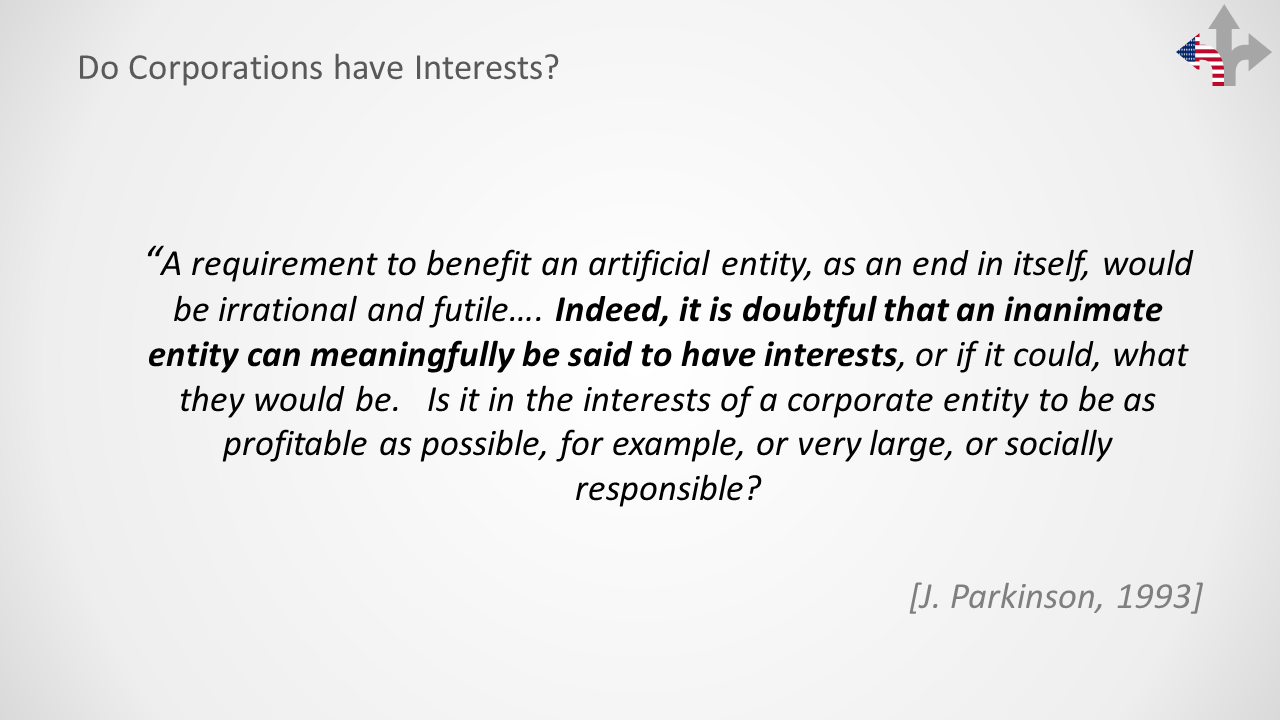

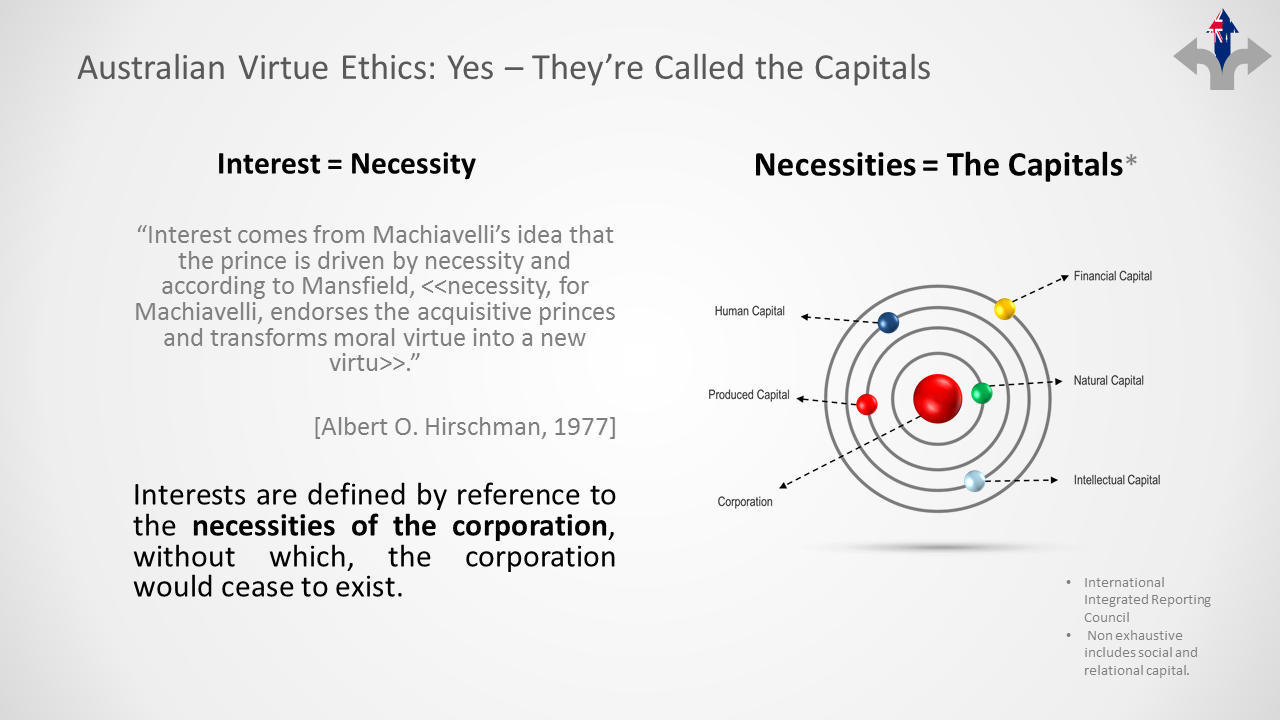

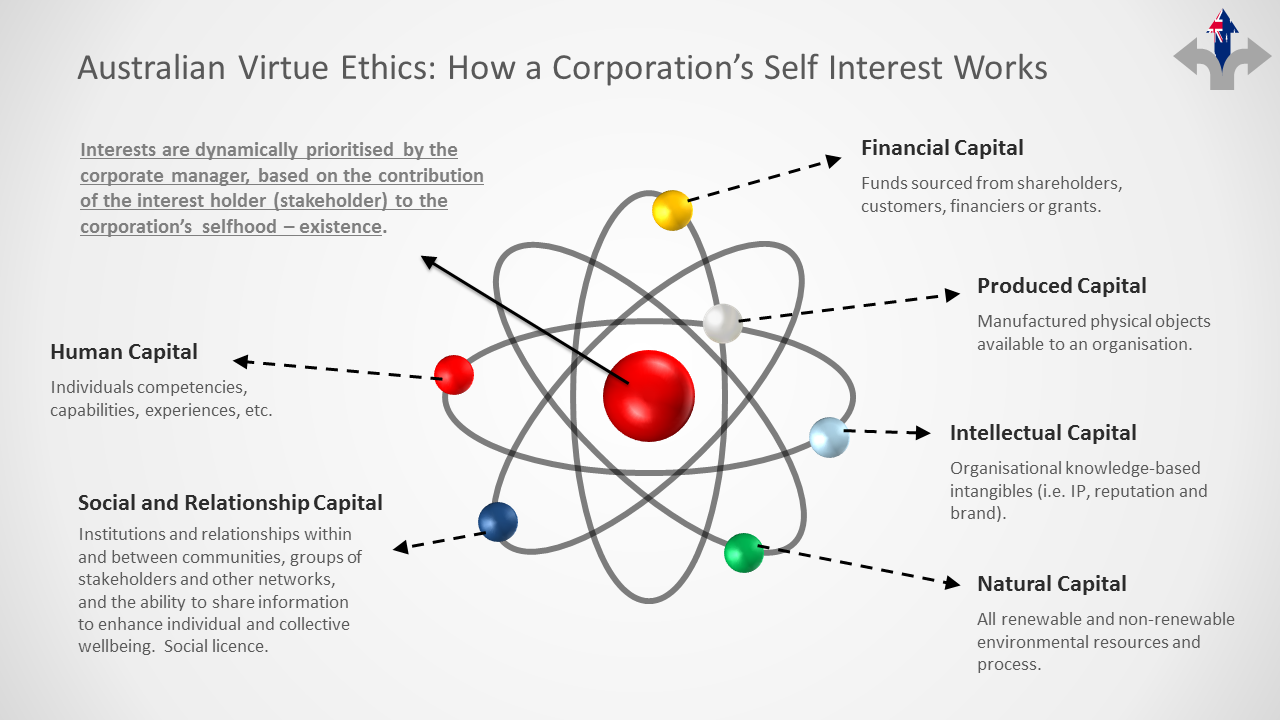

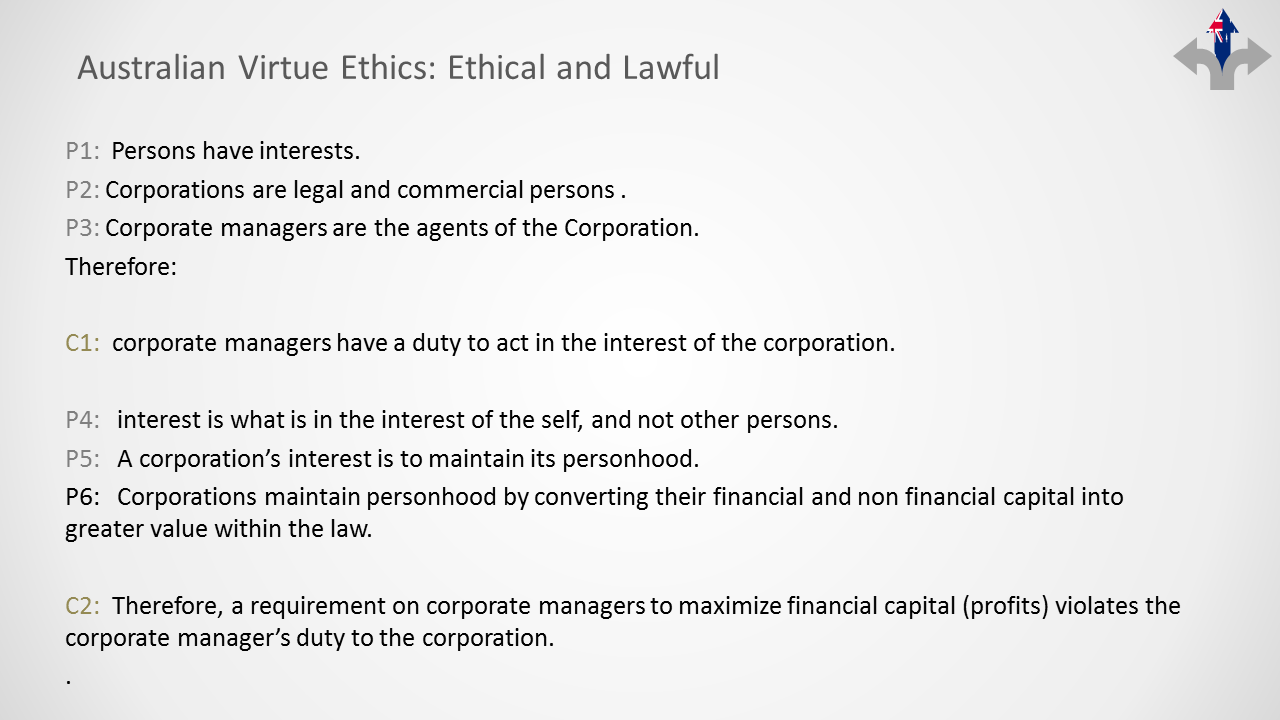

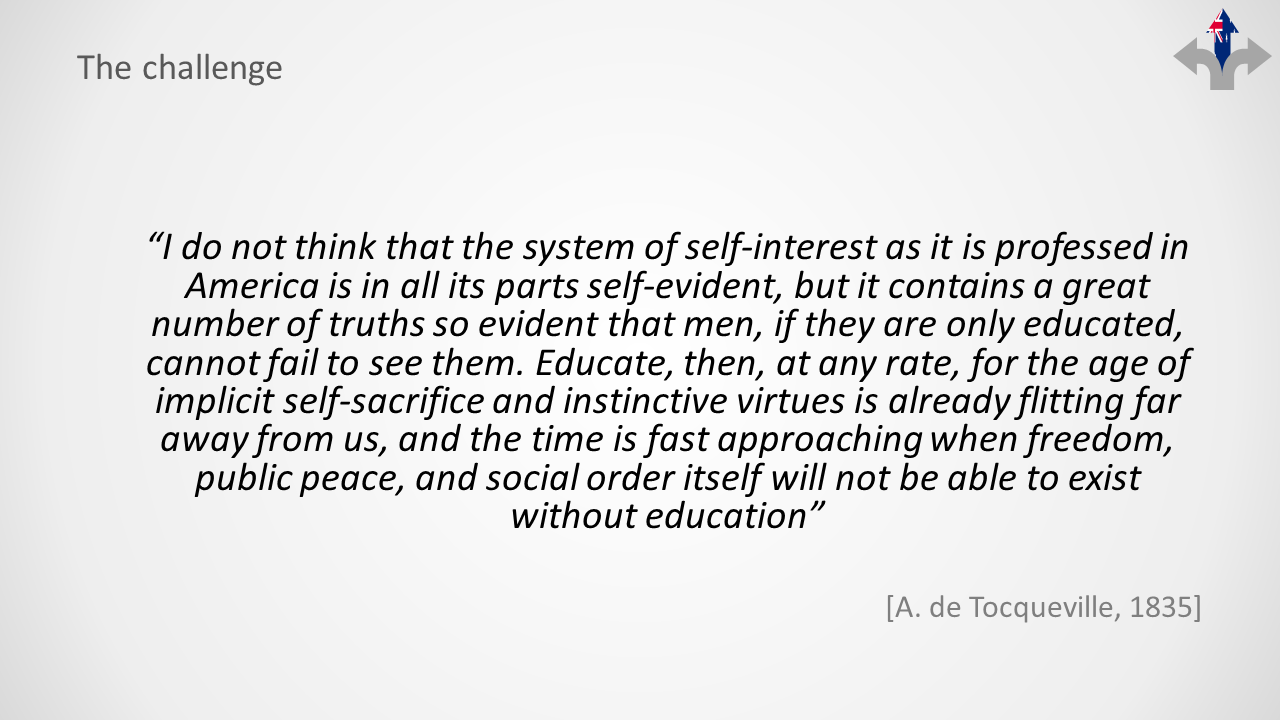

In fact, the ethical foundations of capitalism can be traced all the way to Adam Smith and beyond. But Smith's was a very different kind of ethics. Whereas Friedman based his ethics in obligation, the invisible hand was, and still is, guided by virtue. One is based in duty, the other in self interest.

When we question corporate behavior, it's worth remembering that ethics is at the core of a commercial society, and that corporate governance is fundamentally about how company directors tell right from wrong.

At this year's annual conference for the Association for Professional and Applied Ethics (AAPAE) I presented "Duty vs Virtue: The Ethical Dilemma Confronting Corporate Governance". With the benefit of the generous feedback from those in attendance, here are my slides:

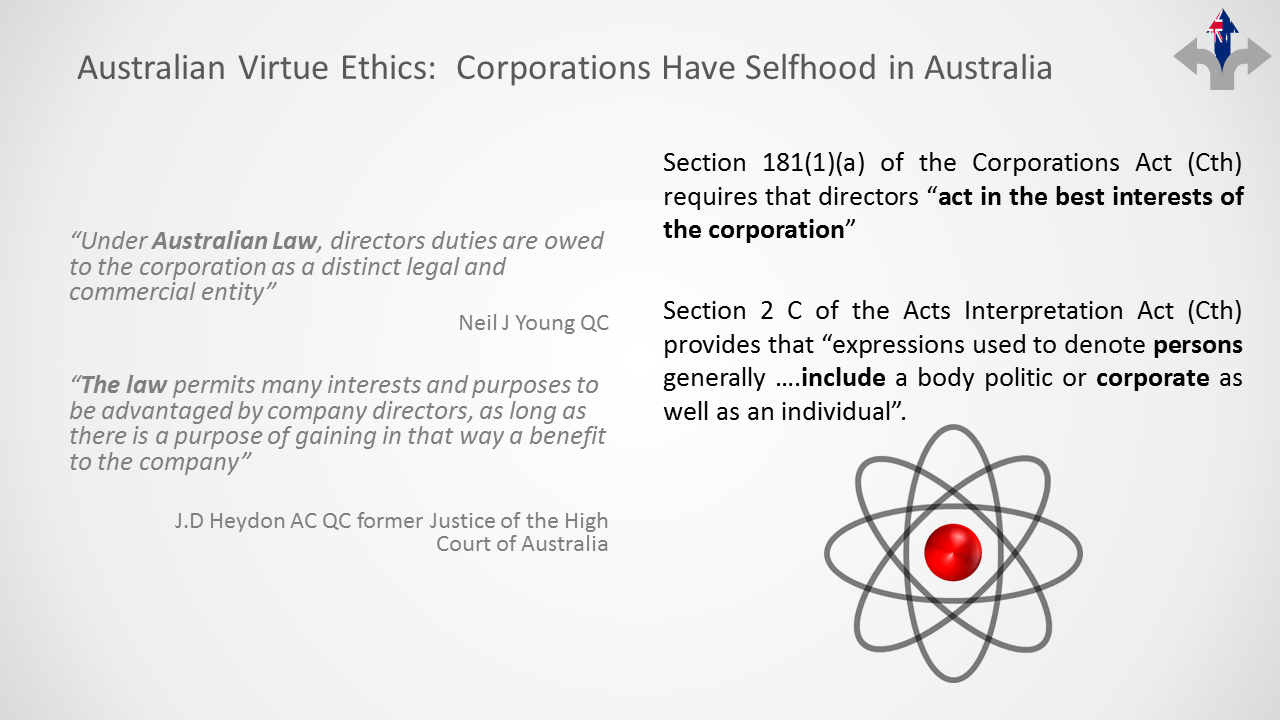

In the months to follow I'll write more about Australian virtue ethics and how Australia can become a safe haven for corporations at risk of financialisation. In the meantime, if you're interested in learning more contact us.

To learn more about the AAPAE click here.