“the problem of value must always hold the pivotal position, as the chief tool of analysis in any pure theory that works with a rational schema”

Schumpeter

When theory of value, understood in terms of exchange, was first conceived the planet was degrees cooler, plants and animals were more diverse, water and air were cleaner and Adam Smith’s water diamond paradox captured the imagination of economists and law makers. The planet was fuller.

In the 19th and 20th centuries the biggest problems to be solved by economics were how to decide prices, wages, the distribution of income in a world brimming with life.

Today, in terms of survival, the world has far fewer useful things.

Smith’s paradox now exists in reverse. Leaving aside that the market for bottled water is now three times that of diamonds, why is it that the things with the greatest price cannot buy the things with the greatest value in use? All the diamonds ever mined unable to reacquire a fraction of the seas, rivers, lakes, and aquifers dried up, diverted, poisoned and polluted in the pursuit of profit and things with exchange value.

As the conditions for livability disappear, economics now has a much bigger problem to solve. One of its own making.

How to generate and regrow all the useful things that no longer exists or never came into existence because humanity pursued a path of economic growth measured in dollars rather than usefulness.

Discoveries

December marks two years since I started to document my search for a theory of value in use. Setting myself the Millennia Challenge. A test to see whether it was possible to theorize a way to decide the best use of a thing or a theory of usefulness.

Today’s post describes the broad research agenda developed in that time. Breaking down my work into a theory of use into first principles and objects and connecting these to various conclusions about what it could mean for economics, law and sustainability. Concluding with the question of whether the notion of value in use is useful.

But a word of caution.

Orthodox economics is remarkable in its unwavering belief that innate human nature, private property, full information and institutions to promote and protect these ideas are all that is necessary to produce the best of all possible worlds. Usefulness, in terms of survival (let alone sustainability) is nowhere to be seen in theories of price and production.

We must therefore enter the parallel world of usefulness “lightly”. Use being different to price, a theory of value in use challenges us to rethink things we thought we understood.

Entry points

To provide safe passage into the economics of value in use, let’s begin by distinguishing the familiar starting points of orthodox or traditional economics from value in use. Setting out the parameters of the sandbox in which the theories of value in exchange and value in use emerge.

In this post I use exchange value theory goes by many names - neoclassical economics, orthodox economics and economics. Whilst more a collection of mathematical models than a single theory, for the purposes of comparison the models share similar entry points and objects leading to homogeneous conclusions.

Systems not Individuals

Economic theory revolves around flesh and blood people. Value in exchange is, by and large, theorized from a humanist perspective. The subject of the theory is the individual holding or receiving a dollar - what they know, what they prefer and how they behave.

The subjects I theorize about are systems or more accurately dissipative open systems (“systems”).

Systems include, but are not limited to, individuals. All systems matter because corporations, states and physical systems also generate value in use. Likewise, all the unpaid work, typically undertaken by women (and excluded from economics), is included within a theory of usefulness. The production boundary for useful things is vastly greater than that of exchangeable things.

Dissipative is emphasized for two reasons. Not all things commonly called “systems” count. If you can’t throw a “markov blanket” over a system its just a metaphor. The subjects of value in use are people and energy structures that possess specific properties that enable the capture, storage, transformation and dissipation of useful things. Second, the word “dissipative” provides a clue as to how systems perform a social purpose without social responsibility.

System Interest not Self Interest

“What happens to exist is the cause of its use”

Lucretius

Building on the idea that the subjects of the theory are systems, the second entry point to understanding value in use is the notion of system interest.

Whereas in economics, self-interest is the idea social welfare is somehow guaranteed when individuals act in their own self-interest based on psychic preference or utility, from a value in use perspective, the organizing principle is system interest.

In value in use economics:

all systems have a variety of welfare “interests” that correspond with their existence and growth.

interests are neither preferences nor profits. Interests are things that contribute to existence.

it is the innate tendency of systems to continue to exist that determines the generation of things with value in use.

Each system generating the conditions for its own existence by ensuring access to accessible and available value in use in its many useful forms. That which exists is the cause of its existence.

However, whilst non-human systems only have interests, individuals have both interests and passions ( an idea translated into the economic concept of utility - tastes , wants and choices). Interests are informed by reason, passions are not. The portrayal of humans in economics as simultaneously rational and self-interested is a hopeless contradiction.

As Machiavelli warned princes, passions compete with and contradict reasoned interests out of ignorance, manipulation and the human condition. Undermining the conditions for the state and, when allowed to co-ordinate the production of all things, as it case with orthodox economics, undermining the conditions for life.

Only One Type of Value- Use not Exchange

Economics is based on the idea that there are two distinct types of value - value in use and value in exchange - and only value in exchange and markets matter. Put bluntly, in economics only things with a price have value.

The consequence of Francois Quesnay’s (who Adam Smith copied) decision to split value in two was to introduce a blind spot and a terrible mischief into history. The fantastic belief that an economic utopia could be realized without any consideration of the real usefulness of the things bought and sold and things sacrificed in the process.

Aristotle thought otherwise. Not one for magical thing, he directed that exchange was not a type of value but a type of use. Understood as a unified concept, Aristotle was then able to theorize the usefulness ( or more accurately the lack thereof) of the market in the production of useful things.

Among the many implications of there being only one type of value, is the ability to bring orthodox economics and value in exchange into the sphere of usefulness and value in use economics. The non- negotiable economic concepts of markets and exchange become examples of what is known in value in use theory as a ”prime mover” and exchange a “transformation”. Making it possible to compare the usefulness of markets that transform commodities into money to other prime movers such as education that transform ideas into action.

The Universal Equivalent - Change not Money

Most readers will be familiar with the the basic idea that money has become the measure by which all commodities are compared and exchanged on the market. A convention that has now been extended to things that cannot be traded in the market from whales to insects.

money can be a unit without intrinsic value, a measuring convention like the inch or the pound.

Value in use economics is based on the idea that money being, in and of itself and under the right conditions, a useful thing it can not be used as a universal measure of equivalence between all other things. Money possesses usefulness but it is by no means a suitable measure of usefulness. It is not a neutral measure.

If we are to compare the usefulness of a dog to a university degree or the usefulness of a dollar to a cultural landmark it would be helpful to have some shared yardstick or universal equivalent to compare things with no obvious commensurable properties. Otherwise our comparison is more likely to be a reflection of our values rather than value.

A neutral reference point or universal equivalent enables us to:

compare the transformation of physical and non physical things; and

theorize the best use amongst those things.

In value in use economics, the work of equivalence is tied to the concept of change. Something measurable directly or through proxies. From a system perspective, all useful things possess some capacity to produce a change that contributes to the existence and growth of that system. Value in use is the invisible substance that animates human and non human systems.

But change is not something spontaneous. It requires energy.

In value in use thought, energy is the common unit. The thing that we know brings systems to “life” and explains and predicts their behavior. But it is not called energy in economics. It is called value in use. At the core of theory is the recognition that energy takes a social form in the form of abstract use ( as opposed to the specific use of a thing). If value in use is available to a system there is potential for work and change. If not, the system will perish.

A notion that shift the foundations of economics from psychology to physics. Inviting us to use the science of change - the second law of thermodynamics - as a conceptual framework for understanding usefulness and developing a theory of value in use. Grounding theory of value in the eternal concrete of the energy concept that flows through all systems.

Disequilibrium Not Equilibrium

Though the laws of thermodynamics may seem to economics what biology is to geology, physics has cast a long shadow over the value problem since the time of Adam Smith. The concept of value in the Wealth of Nations regarded as the counterpart to the concept of energy in physics (Mirowski).

A tradition passed from the classical to the neoclassical schools of economics. The first law of thermodynamics the model for theory of general economic equilibrium. The idea that the interaction of supply and demand will tend tend towards balance a core axiom of modern economics.

Value in use shares a similar orientation. However, not to the first law which is concerned with the quantity of energy, but the second law.

The second law of thermodynamics is concerned with the quality of energy and entropy. According to the second law, nature loves a gradient and disequilibrium. The tendency of things to move from a more useful state to a less useful state providing a natural starting point from which to theorize the behavior of value in use within and between systems.

If this sounds lie science fiction, you need only observe the market to see the power of disequilibrium.

More Familiar Entry Points

Other entry points are similar to value in exchange theory but again from a non-humanist perspective:

Systems have endowments or access to things that are useful to sustaining existence ( “capitals”)

Systems have access to abilities to transform things to sustain existence ( called “prime movers”)

Systems have exclusive use of certain things. The things within the boundaries of that system and unavailable for use by other systems.

But, though a system might have exclusive use of a thing it does not follow that things capable of exclusivity are always the most useful. The Coasean belief in the primacy of property rights and fungibility of value in exchange for all things an example of more magical thinking.

To be clear, value in use economics is not based on a grand historical narrative ( as seen in Marxian economics) or broad macro economic variables (as seen in Keynesian economics). Rather, it is intended to analyze the relationship between Systems, discrete “transformations” of things called “capitals” and the aggregate generation of value in use through those transformations.

Unlike economics that is dissociated from the world of things, value in use is grounded in the nature and property of things and how the transformation of these things leads to survival, sustainability and ultimately flourishing.

This approach to value in use implies that processes at the societal or macro level can be ascribed to transformations of things at the micro level. Thus, the contemporary problems of economics associated with the climate emergency and biodiversity loss can be described and explained by referring to whether a use of a particular thing increases available value in use, decreases it or generates the opposite of value in use - ineffable counter value.

By replacing the economic concept of the self with systems and utility with the welfare interests of that system a new set of objects emerge that explain and describe how value in use is generated.

Objects

In neoclassical economics, the theoretical bridge between entry points (discussed above) and their social welfare conclusions (discussed below) are provided by various objects including- individuals, firms, markets, supply and demand, production and consumption, market equilibrium and the concept of an externality. Each supported by over a century of analysis and discussion.

In value in use theory these objects are replaced with different ones.

But before briefly introducing the objects of usefulness, you should be aware that having a different entry point and logic to neoclassical economics, new words are needed and familiar words may carry different meanings.

Through the challenge I’ve done my best to define terms when introduced, but there is always a risk that the reader inadvertently carries the value in exchange meaning into a discussion on use. Mindful of the confusion this inevitably creates, I’ve tried to formulate a way of describing the objects of the theory without using value in exchange terms.

That said, I’ve still found the need to invent words. When academia engages with my work it’s almost exclusively to chaste me for my choice of words. Warning me off engaging in new ideas lest I confuse the already confused reader.

In my defense, Marx invented and defined “surplus value” as something different to “profit”. Likewise, neoclassical theorists proposed “marginal utility” to differentiate some individual choices from others. I’m always open to suggestions from the scholar’s who criticize my work but as they don’t engage in the substance it’s difficult to take their criticism seriously. Unwilling or unable to engage, they remind me of junior lawyers, who when reviewing contracts, limit their red-lines to grammar and typos.

With that in mind, here are some of the key objects I use to connect my entry points to my conclusions. Please forgive me if I’ve described something badly in a way that I’ve previously described well:

Value in Use - Energy in it’s social form. The universal measure of equivalence between all things that are useful.

Systems - Entities that possess the characteristics of a dissipative open system including individuals, corporations and states.

Capital - Things that stores Value in Use.

Forms of Capital - The various forms of capital both physical (natural, human, manufactured) and fiat ( financial, social, intellectual, promissory).

Available - Capitals that are available for use by a System on an exclusive or non exclusive basis.

Accessible - Capitals that are capable of being transformed by a Prime Mover.

Entropy - The measure of the Value in Use within a Capital becoming unavailable to a System.

Transformations - The process by which forms of capital available and accessible are transformed thereby generating less or more Value in Use.

Prime movers - The mechanisms responsible for Transformations.

Disequilibrium - Market based Transformations between Systems that generates Value in Use.

Counter-Value - the opposite of Value in Use.

If markets are the key to understanding value in exchange, entropy is the key to value in use. But it is not the entropy of disorder, randomness, or uncertainty and chaos. It is entropy associated with the availability energy in science or value in use in economics. The tendency for value in use to become unavailable to systems the motive force behind value in use and generation of useful things.

Admittedly descriptions are not a theory and therefore you’ll need to read the work to follow the specific rules about how theses objects connect the entry points to describe and explain the “best use of a thing”. That said, whilst the concepts may be foreign to economists, those familiar with the science of energy, might recognize the logic.

In summary, the theory holds that usefulness is generated when a System employs a prime mover, such as an individual or a market to transform one or more capitals that are available to it to do useful work or generate a capital that possess more value in use than was previously available to System. Critically the motivation for the transformation is not to satisfy a human preference or to create a financial profit but entropy, understood as the availability of energy, Transforming capitals to ensure a net increase in value in use available and accessible to the System. That increase being the best measure of a system’s likelihood of existence and growth.

Moreover, because systems do not exist in a vacuum, the combination of the intersection of interests between systems and the tendency of value in use to become unavailable to systems but available in the environment serves a social purpose without social responsibility.

Is a theory of Value Useful in a Climate Crisis

The “enemy” in the battle for our shared future is typically framed in terms of carbon, commodities and consumption. Outside the marxian critique, there is virtually no public discussion of the contribution of theory of value to the causes and responses to the grand challenges of the early 21st century.

The absence is conspicuous given that every government decision and action will, to some extent, be assessed by politicians, regulators and public servants against the assumptions and logic of a theory of value. More particularly, orthodox economics and the axioms of neoclassical economics.

However, this presents paradox.

Whereas, the science tells us that to avoid the worst impacts of climate change temperatures must be limited to 1.5c, there is scant science or consideration of usefulness in the ways governments evaluate how to get there. Science might inform the intervention but is the framework for evaluating the intervention scientific or fit for purpose.

Is a Theory of EXCHANGE value Useful ?

Economists have made it “their mission to maximize the welfare of ordinary people” (Fourcade et al). In the face of social crisis, insisting that politicians and planners adopt welfare economics for making their most important decisions.

But I wish they’d chosen another hill for us all to die on.

The economist’s notion of welfare is not the same as usefulness or value in use. Rather, an individual’s preference satisfaction is assumed to be a reliable proxy for human well being or welfare. In economics the presumption is that the best use of a thing and the optimal outcome for all can be derived from what an individual prefers and what they’re willing to pay for:

The power of a perfectly functioning market rests in its decentralised process of decision making and exchange; no omnipotent central planner is needed to allocate resources. Rather, prices ration resources to those who value them the most and, in doing so, individuals are swept along by Adam Smith's invisible hand to achieve what is best for society as a collective. Optimal private decisions based on mutually advantageous exchange lead to optimal social outcomes.

Hanley et. al.

According to the theory, people preferences are the only criterion to determine whether a state of affairs is desirable or not. Providing a convenient way to measure welfare based on cause (the choice) without having to be troubled by the effect (the consequence of the choice). Avoiding the problem of physics, entropy and biophysical limitations all together.

Moreover, as these preferences can be revealed through prices, markets are seen as the best, if not only, way to co-ordinate human welfare. In value in use terms, markets become the apex prime mover that transforms everything within its reach into welfare and profits in equal and perfect measure.

But none of this is divined from nature or made subject to the laws of nature.

Welfare economics is largely a product of the mind and mathematics- individualism (rational humans), instrumentalism (preference satisfaction) and equilibrium. The latter occurring when individuals maximize their preferences and firms their profit everyone is assumed to find themselves in an equilibrium state representing the ideal social welfare conditions.

There is no science to neoclassical economics. (Nadeu, Costanza). Only the pretense of science. Mathematical formalism disguising deeply normative values masquerading as value.

Nor, is there is a theoretical consideration of:

the impact that preferences have on on value in use or “real” welfare measured in terms of livability and access to things that are useful - habitable spaces, clean air, water, social opportunity or

the relationship between profits, preference and the the production of the most useful things in the context of survival.

Not that these theoretical limitations prevent economists lining up to provide answers to the crisis of usefulness.

Almost all solutions put forward to combat rising temperatures and the growing list of environmental and social crisis being extensions or modifications of the neoclassical framework:

pricing more things and “right” pricing through taxation and other means

providing more “material” information

creating more market to better co-ordinate preferences

substituting declining natural capital with increasing manufactured capital - if drones can do the work of bees, the loss of the bees won’t impact GDP - will it?

It seems that the one thing politicians are not willing to give up in the name of climate change is orthodox economics. Governments prepared to spend countless billions on the basis of spurious logic rather than invest in the development of alternative forms of economic thinking.

Put simply, how can a theory of value without any biophysical basis whatsoever be useful in solving a biophysical crisis? Moreover, if orthodox theory of value was unable to predict or avert the current crisis, what evidence is there that welfare economics will deliver us from the current crisis. Questions that deserve to be on every politician’s radar.

Is Theory of VAlue in use Useful

Being based in the idea of systems, entropy and change, value in use offers an alternative perspective on both the causes and solutions to many of challenges we confront.

That said, from my perspective it’s too early to tell whether we can deduce from theory any useful conclusions. And, in any event, it might be too late.

Though, on the face of it, theorizing value in use could be useful for a number of reasons:

It exposes at least two fundamental flaws in neoclassical thinking:

Usefulness playing no part in the decision making of what is produced, things are produced that are not useful and things that are useful are destroyed in the process of production.

Firms being:

responsible for most of the production of things, and

motivated solely by profit

do not produce things that are useful to the survival, sustainability and flourishing of firms that result from transforming profit into rarer treasurers - social, human and intellectual capital. Firm become overcapitalized in what is not required for existence ( financial capital) and under capitalized in what is required for existence.

It provides an alternative basis for corporate law and corporate governance. Imagine institutional frameworks designed to ensure the freedom of corporations to elevate “stakeholders” based on contribution to existence. Where the best use of money is to invest it into stakeholders because that results in the greatest value in use to both the corporations and employees, suppliers the community and the environment.

It points to unrealized sources of value in use in the community and environment. Available but trapped because we have not discovered, designed and constructed the engines that transform that value in use into socially beneficial change.

It explains the deeper embedded mechanisms that systemically lead to the destruction of useful things such as cooler planet, cleaner air a richness of culture and all things a society requires to flourish.

It might be a currency of sustainability. Offering a way to disconnect economies from the dependence of material things that possess value in use by shifting to sources of value in use that do not have a material form - intellectual, social and human capital. Focusing economies on generating value in use rather than “de-growth”

The potential for value in use, understood as energy in its social from, to be added as a tool to conduct research and draw conclusions about the world is not zero. As I remind myself, I am not so smart as to be 100% wrong.

However, the probability of value in use drawing the attention of politicians away from value in exchange is low. With studies showing upward of 95% of economists identify with the neoclassical tradition, it’s hard to imagine a sole practitioner from Melbourne, Australia challenging their hegemony or influence. Economists are resilient as they are driven to ensure social welfare is maintained on a warming and unpredictable planet.

That said, if theorizing value in use, however badly, could bring back some butterflies or save a life, what threshold should be applied when considering usefulness in the context of sustainability and regeneration? With King Charles III predicting that it will cost $5 trillion every year to save the world from climate catastrophe, some of that could be spent thinking deeply and systematically about value in use. It could be a lot cheaper?

How Does Value in Use become Useful

Despite value in use holding promise, none of this means a theory of usefulness is currently useful.

A remarkable feature of value in use thinking is, for the theory to be valid, it must be capable of explaining why a theory of usefulness might not be considered useful. Logically, if a theory of usefulness was useful it would be put to use. But, in my experience, that’s not the case. Most people with whom I share my work are largely uninterested.

In my experience, value is a word that is spoken not thought.

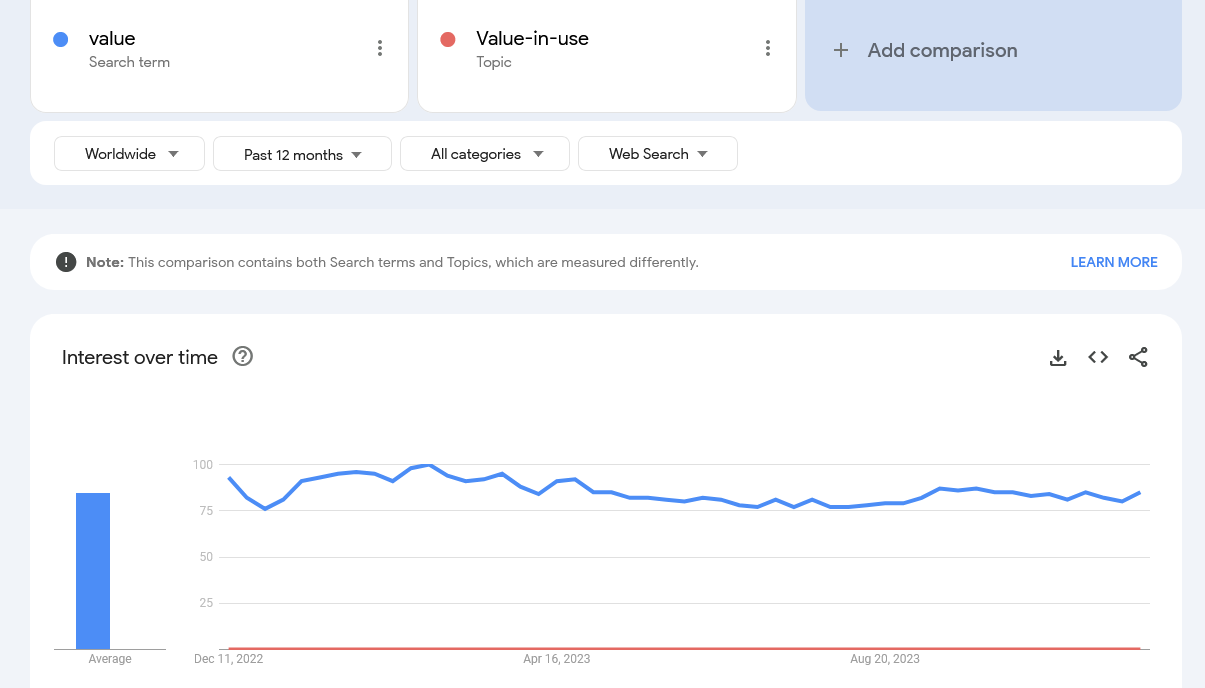

Based on trends, value in use is on virtually no ones radar. A phenomena that is predicted by the theory. Theories, in and of themselves, are inert forms of intellectual capital. A source of usefulness that is available but, in the absence of prime movers, trapped. Inaccessible. Truth does not spontaneously go viral. It requires prime movers.

Without these engine to transform the theory into action, no work of change can be done:

scholars to transform the theory of value in use into legitimate objects of scientific inquiry;

education to transform the theory of value in use into an object of cultural salience (something recognized by society as “real”);

institutions that transform the theory of value in use into hard law ( corporate law) and soft law (corporate governance);

practitioners who transform the theory of value in use into new “tools” that generate useful things; and

friends like David Hume was to Smith introducing him to friends in high place, Friedrich Engels was to Marx who wrote glowing reviews under many an alias and so many academics have been to Milton Friedman who cited the economist well beyond his usefulness.

Prime movers that from 1776 and Smith’s 'An Inquiry into the Nature and Causes of The Wealth of Nations'. to 1976 and Michael Jensen and William Meckling’s article “Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure” have done the invisible work of transforming the planet from livable to unlivable.

If we are to regrow all the useful things that no longer exists or never came into existence because humanity pursued a path of economic growth measured in dollars rather than usefulness, it is not enough to theorize value in use.

Until we start feeding the prime movers a new theory of value they will continue to do their work of transforming the theory of exchange, prices and production into less and less. Each lesser thing commanding a higher and higher price but none able to buy the planet’s survival.